|

|

GameStop is Riding the Digital Tiger In the Video Game Market, It's Eat or Be Eaten At their most recent SEC filing, GameStop reported sharply declining sales. This gave many a reason to say that GameStop had finally hit a brick wall because of declining retail store traffic, increasing competition from iPads and iPhones, and skyrocketing online sales from the publishers directly to the consumers. At their most recent SEC filing, GameStop reported sharply declining sales. This gave many a reason to say that GameStop had finally hit a brick wall because of declining retail store traffic, increasing competition from iPads and iPhones, and skyrocketing online sales from the publishers directly to the consumers. While all these factors are real, they do not necessarily spell the demise of GameStop today or tomorrow. Firstly, a look at the market place in the United States. The most important trend is that of skyrocketing online sales. There is no question that these are clearly the trend of the future. Six months ago, in this publication, I projected the overall video game sales curve forward to 2020 for both online sales and brick-and-mortar retail sales:  and added that  “The next decade promises to be interesting. In all probability, broadband improvements will lead to real and fundamental change in the way in which video game products are sold. The winners are likely to be the publishers of software and the providers of Internet based services such as OnLive, Gaikai and others. The losers are likely to be the brick-and-mortar retailers unless they manage to move their business online.” “The next decade promises to be interesting. In all probability, broadband improvements will lead to real and fundamental change in the way in which video game products are sold. The winners are likely to be the publishers of software and the providers of Internet based services such as OnLive, Gaikai and others. The losers are likely to be the brick-and-mortar retailers unless they manage to move their business online.”The latest NPD numbers confirm that this trend is well under way as far as brick-and-mortar sales of new video game products (except downloads and used games) are concerned:  Does this mean that GameStop can be counted out?. No, I do not think so. It is obvious, in retrospect, that they recognized nearly three years ago that the choice facing them was to either ride the digital tiger or be eaten by it. And not so surprisingly, they chose the former rather than the latter. They hence began to to embark upon a focused, logical, and well thought-out strategy to cope with the online challenge facing them. This is how the sequence of events unfolded:

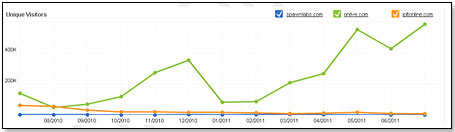

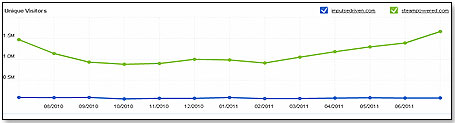

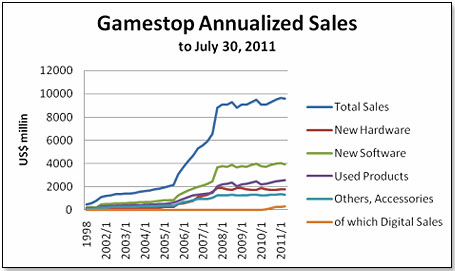

In summary, GameStop first decided to create an instrument with which to execute the company’s digital strategy, staffed it with good and experienced people, and then made the acquisitions and implemented other initiatives to give muscle to the effort. However, the implementation still has ways to go if online activity is any guide (and given that we are discussing an online commercial strategy, online performance is probably the best of all yardsticks). First, their entry into the social gaming world with Kongregate:  Here, GameStop is making clear progress against its main competitor, Miniclip. Secondly, their entry into the online “cloud” gaming sphere against OnLive:  Here, GameStop is not making any headway. In fact, their web traffic for both Spawn and Jolt suggests that they are losing ground against the heavyweight in this space, OnLive. Third, digital distribution:  Again here, Steam, the market leader, is clearly holding its own against Impulse. So, finally, how is the company doing in its various product categories? This is how their annualized sales looked at the end of July 2011:   While Digital Sales are clearly not a major contributor at this point, it is one of only two growing categories – the other being sales of pre-owned products. In this, GameStop is very much in line with the market as projected in my first graph at the beginning of this article (Annualized Video Game Market U.S.). While Digital Sales are clearly not a major contributor at this point, it is one of only two growing categories – the other being sales of pre-owned products. In this, GameStop is very much in line with the market as projected in my first graph at the beginning of this article (Annualized Video Game Market U.S.).There is no doubt that GameStop has clearly recognized the opportunity inherent in the Digital space, and they have set about entering it in a well planned and forceful manner. However, have they recognized that the strategy they are pursuing also has pitfalls for their business? For instance:

There is no question that the managers at GameStop are extremely capable and intelligent people. However, the company may well be in a situation where they are damned if they do and be equally damned if they don’t. The trouble is that the digital tiger is not the only predator that can eat you in this jungle called the video game market place.  Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author Writer's Bio: Lutz Muller is a Swiss who has lived on five continents. In the United States, he was the CEO for four manufacturing companies, including two in the toy industry. Since 2002, he has provided competitive intelligence on the toy and video game market to manufacturers and financial institutions coast-to-coast. He gets his information from his retailer panel, from big-box buyers and his many friends in the industry. If anything happens, he is usually the first to know. Read more on his website at www.klosterstrading.com. Read more articles by this author |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Disclaimer Privacy Policy Career Opportunities

Use of this site constitutes acceptance of our Terms of Use.

© Copyright 2026 PlayZak®, a division of ToyDirectory.com®, Inc.

If the tests designed to broaden the product base are not successful, then the only option over time is to cut store counts. This in turn will lessen GameStop’s attractiveness as a retailer to publishers and hardware manufacturers, who will then probably be persuaded to put increasing emphasis on going directly to the consumer via the digital route. This will result in increased pressure on GameStop’s stores.

If the tests designed to broaden the product base are not successful, then the only option over time is to cut store counts. This in turn will lessen GameStop’s attractiveness as a retailer to publishers and hardware manufacturers, who will then probably be persuaded to put increasing emphasis on going directly to the consumer via the digital route. This will result in increased pressure on GameStop’s stores.